What is the Stable Income Fund?

The Stable Income Fund ("the SIF") is a conservative NYS Deferred Compensation Plan (“NYSDCP”) investment option with the objectives of preserving capital while earning a modest current income. Participants can move money in or out of the SIF on a daily basis without penalty.

The SIF is composed of a number of stable value contracts, commonly known as “wrap contracts” that are coupled with separately managed, investment grade fixed income (bond) portfolios. The portfolios include primarily U.S. Treasury and government agency bonds, corporate bonds, mortgage-backed securities, asset backed securities, and some limited derivatives and other fixed income investments.

The investments in these portfolios are high quality, having a minimum weighted average credit quality in each portfolio of “AA-” or higher, with individual securities having a minimum rating of “BBB-“ or higher as determined by major U.S. rating agencies. For reference, debt-rated AAA is the highest rating, so a AA-rating is considered very high quality, and BBB- is the demarcation line for debt that is considered investment grade, a mark of high quality as well.

The SIF is a unique investment strategy that provides a reasonably stable income over time in most market environments. The SIF is well diversified across multiple fixed income sectors and securities with investment managers using varying styles of investing. For example, as of December 31, 2022, the SIF held 12 different fixed income portfolios with varying average maturities and investment styles with wrap contracts issued by 7 different insurance companies and banks.

In addition, there is an overall stable value structure manager who is responsible for selecting and negotiating the stable value contracts, managing the Fund's liquidity, and monitoring and recommending investment managers among other responsibilities.

How do wrap contracts work?

The wrap contracts are issued by banks and insurance companies and are individually negotiated specifically for the SIF. These contracts are held in combination with the Fund's fixed income portfolios and obligate the bank or insurance company issuer to maintain a separate record of the contract's value called the 'book value' of the contract. The book value is the value participants see in their account. Under most circumstances book value is equal to the value of the invested principal plus accrued interest, adjusted for deposits, withdrawals, and fees.

The wrap contracts also obligate the bank or insurance company issuer to calculate an interest rate at which the book value will grow called the crediting rate. The crediting rate is reset each month using the yield and duration of the fixed income portfolios, adjusted for realized and unrealized gains and losses on the fixed income portfolios.

Simply, the value of the SIF is calculated using the book value of the stable value investment contracts rather than the market value of the fixed income portfolios. As a result, SIF’s value and performance is insulated from the daily market value fluctuations of the fixed income portfolios.

How is the SIF expected to perform in various market environments?

Historically the Fund has successfully generated a higher average yield than many alternative conservative investments, including most money market funds and shorter-term certificates of deposit. For the ten-year period ending on December 31, 2022, the Fund achieved an average annual return of about 2.0% per year, while the average money market fund measured using the iMoneyNet Money Fund Average1 returned about 0.8% per year. This higher return is primarily because the SIF invests in fixed income securities with longer maturities than money market funds, and historically securities with longer maturities have on average over time provided a higher yield than shorter term securities.

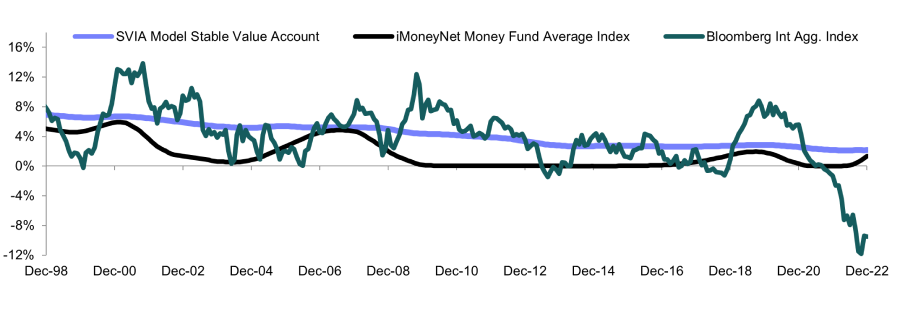

The SIF's yield is expected to gradually follow the long-term direction of intermediate maturity market interest rates, but with a time lag. The chart below illustrates how a model stable value portfolio2, which uses a strategy like the SIF, has performed versus a money market fund average and an intermediate maturity bond index over rolling one-year periods. The chart shows that the model stable value portfolio has performed consistently higher than the money market fund average over most of the last 20 years and offered a "smoother" less volatile return over time than the intermediate term bond index.

Rolling 1 year returns3

Understanding Returns

During times of rising interest rates, the principal protection feature of the stable value contracts becomes particularly important. For example, throughout 2022 many fixed income portfolios experienced negative returns as the U.S. Federal Reserve raised interest rates seven different times by a total of 4.25% to reduce inflation.

As a result, the Bloomberg U.S. Aggregate Bond Index, a measure of the broad bond market, delivered a return of negative 13.0% (-13%). However, the SIF delivered a return of positive 1.8% over the year 2022 (+1.8%), thus allowing plan participants to preserve capital and increase the value of their investment, even as prices on many fixed income securities were going down.

While the SIF's return has historically outperformed the return of money market funds for many years, in more recent months the yield and return on money market funds has exceeded the yield and return of the SIF. This can happen during periods of rapidly rising interest rates.

The reason is that money market funds have investments with shorter average maturities, and as those investments mature more quickly than the longer maturity investments held by the SIF, the proceeds are reinvested into higher yielding instruments at the prevailing higher short term interest rates. This allows money market funds' yields to "catch-up" to current market yields faster than the SIF.

Also, because of the U.S. Federal Reserve raising short-term interest rates so rapidly, investments with shorter maturities have been earning a higher yield than those with longer maturities over recent months. In this kind of market environment, referred to as an inverted yield curve environment, money market funds and other conservative short-term investments like bank certificates of deposit (CDs) may generate higher yields and returns than the Stable Income Fund.

In other words, the SIF has historically outperformed most other very conservative investments over the longer term but there are occasions when it does underperform.

Are there risks to investing in the Stable Income Fund?

While the SIF is designed to be a safe and conservative investment, like any investment, investing in the SIF can involve certain risks, some of which are summarized here. There is no guarantee that the SIF will achieve its goals and objectives nor is an investment in the fund insured or guaranteed by the State of New York, the U.S. Government or any government agency including the FDIC, or any other entity.

In limited circumstances, the SIF's value could fluctuate up or down without advance notice, so it is possible to lose money investing in the SIF. The creditworthiness of the issuer or guarantor of fixed income securities or wrap contracts, or the counterparty to derivatives contracts, may deteriorate and become insolvent, default, or the issuers may otherwise fail to meet their financial obligations.

Certain terms of the wrap contracts, including events of default, market value adjustments and termination, may require a reduction to the book value of the contract and therefore the SIF's value. The market value of the Fund's fixed income portfolios will fluctuate due to several factors including changes in interest rates or inflation, adverse economic conditions, reduced market liquidity, manager performance or other factors affecting the securities markets.

The Fund's yield and return will be affected by cash flows into and out of the Fund, including contributions, withdrawals and exchanges from other plan participants, and the SIF's returns may not keep pace with the rate of inflation or the cost of living.

In summary

The Stable Income Fund ("the SIF") is a conservative NYSDCP investment option with the objectives of preserving capital while earning a modest current income. It is important to realize that the SIF is continuously monitored by the stable value structure manager to meet those objectives in both calm and turbulent markets.

For more general information on Stable Income Funds, the Stable Value Investment Association resources page has a number of good articles on stable value: https://www.stablevalue.org/resources/.

[1] The iMoneyNet Money Fund Average is the all-taxable money fund report average, a product of iMoneyNet, Inc., and is presented gross of fees.

[2] The model stable value portfolio return was calculated by the Stable Value Investment Association, and industry trade group.

[3] Source: Stable Value Investment Association (SVIA). The SVIA Model Stable Value Account (“Model”) represents a hypothetical “wrapped” account created using Bloomberg Intermediate Government/Credit Bond Index data to represent underlying fixed income investments. The iMoneyNet Money Fund Average Index is the all-taxable money fund report average, a product of iMoneyNet, Inc., and is presented net of certain fees and expenses.